Did America Just Hand China the Future of AI?

How the sanctions boomerang is fueling Beijing’s tech dominance—and what it means for you.

The supreme art of war is to subdue the enemy without fighting.

— Sun Tzu.

Let’s cut through the noise.

Donald Trump didn’t wait for a Monday press conference. Last weekend, he took to Truth Social—his digital megaphone—to declare a “total reset” in U.S.-China trade relations. “GREAT PROGRESS MADE!!!” he typed, three exclamation points, all caps.

Eight hours of closed-door talks in Geneva followed. Treasury Secretary Scott Bessent met China’s vice-premier He Lifeng for talks meant to de-escalate tariffs.

So there’s a 90-day cease-fire. U.S. duties sink to 30%, China’s to 10%. That sparked a 1,100-point Dow surge. Yet all these are empty noises. Whether duties inch up or down next quarter, the only dial that matters—long-term tech supremacy—barely twitches.

If the goal were simply closing the trade gap, Washington could sell more chips and jets. Instead, it’s doing the opposite—cutting China off from them. That’s because tariffs on soybeans and steel are yesterday’s skirmish. Tomorrow’s war is fought in silicon and software.

From Tariffs to Tech Trenches

Because of the loud noise, people forgot a universal law: pressure breeds resilience. Every U.S. ultimatum sets off a starter pistol in Beijing: “Decouple—and do it yesterday.” In trying to hobble China, Washington may have turbocharged “Made in China” into “Invented in China.”

This is an example of the classic unintended consequence—the adversary grows strongest in the very area where you sought to contain them.

Which drops us at the beating heart of the digital economy: artificial intelligence—and the leather-jacketed ringmaster whose GPUs animate nearly every AI model, Nvidia’s CEO Jensen Huang.

If the man can no longer look a reporter in the eye and say he’s ahead of China’s up-and-comers, the game is over.

Jensen Huang answering questions on China

Silicon, Not Soybeans

The painful irony? Nvidia’s dominance actually depends on China’s reliance on Western tech. Yet U.S. policy is busy undercutting that reliance.

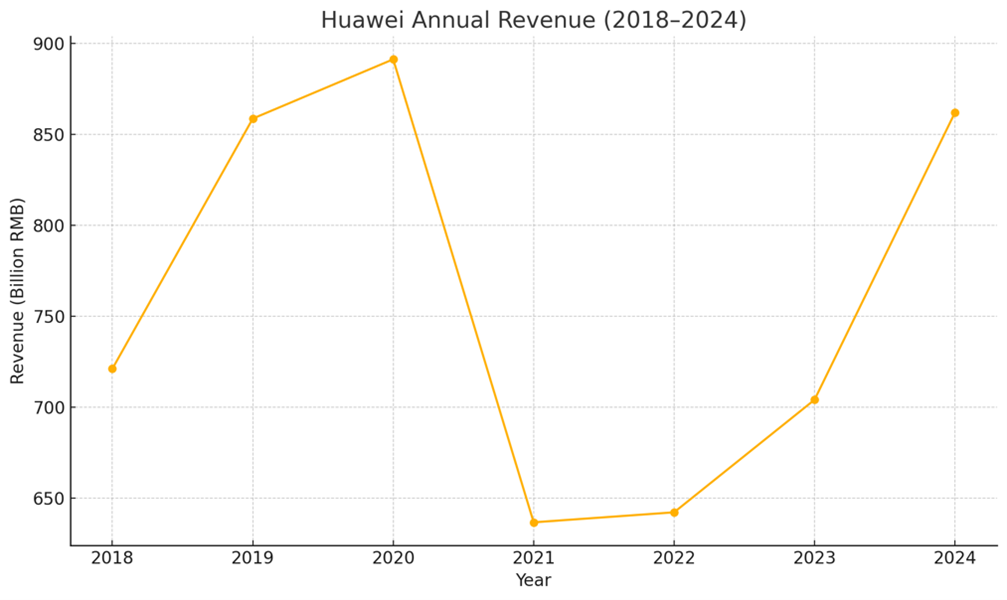

Remember Huawei? Washington banned it from using Google’s Android OS in May 2019 and tried to bury the phone giant—only for Huawei to have its second-best year ever in terms of revenue in 2024. The company found a workaround.

Now the same thing is happening with Nvidia’s AI chips (GPUs).

If Nvidia is America’s national champion, you’d think the U.S. would want Beijing hooked on their products. Instead, the export squeeze practically begs Chinese engineers—of which there are plenty in a country of 1.4 billion people—to build home-made replacements for Huang’s chips.

It’s as if Trump saw what was not working with Huawei and then decided… to double down. Let me explain.

According to a recent survey, 64% of professionals feel overwhelmed by how quickly work is changing, and 68% are looking for more support to keep up. If you enjoyed this article and it brought you clarity, could I ask a quick favor?

Subscribe now. It’s free and takes just seconds to sign up.

You’ll join thousands of other ambitious managers and CEOs getting exclusive, research-backed insights straight to their inbox. Let’s keep you one inch ahead.

How Nvidia Built (and Guards) Its Moat

When most people think about Nvidia’s power, they picture rows of sleek black chips. But that’s like saying a Ferrari’s advantage is its paint job.

Nvidia doesn’t just sell powerful engines (their GPUs); it ships the exclusive operating system that makes those engines indispensable. That iOS is CUDA—think of it as a private programming language for Nvidia GPUs.

This was Jensen Huang’s masterstroke, a bet he made way back in the late 2000s, long before AI was the buzzword it is today. He saw the potential for GPUs to be general-purpose computing workhorses, not just for making video games look pretty.

His answer to the classic chicken-and-egg problem (no users, no software; no software, no users) was simple: give CUDA away.

Nvidia made CUDA freely available—but crucially, not open-source, keeping it proprietary. That allowed researchers to experiment using the gaming cards they owned—no additional cost, no barrier to entry.

But Nvidia didn’t stop there.

The company meticulously built an entire ecosystem around CUDA with extensive libraries of pre-built, optimized components. Their system had a range of benefits:

Free but closed: CUDA cost nothing to try, yet remained proprietary—so while innovation flowed in, IP stayed home.

Plug-and-play libraries: Pre-built, GPU-turbocharged LEGO blocks slashed development time.

White-glove evangelism: Huang’s engineers sat with scientists, rewriting algorithms for 10× speed improvements, creating instant loyalty.

Network effect: Each new coder added fresh tutorials, bug fixes, and FAQs. The more users a system has, the easier life gets.

When the AI boom hit, CUDA was already the de facto standard iOS for machine learning. Developers could focus on models while Nvidia fine-tuned the engine—like driving an automatic instead of rebuilding the transmission.

The more code scientists wrote in CUDA, the heavier the exit penalty grew. Once your codebase, toolchain, and team’s muscle memory live inside CUDA, ripping it out is like performing open-heart surgery. By the time “deep learning” became a household term, Nvidia’s lead looked bulletproof.

But every monopoly looks unassailable—right up until the instant it isn’t. Nothing is invincible when a rival the size of Huawei decides to storm it.

Huawei’s Three-Pronged Attack on CUDA

Remember HarmonyOS? After losing Android, Huawei built its own mobile OS. Now it’s rewriting the playbook for AI, and it’s startlingly straightforward:

First, build your own stack. CANN (Compute Architecture for Neural Networks) is Huawei’s CUDA equivalent—their proprietary programming environment for Ascend chips.

Second, make the transition painless. The company is building bridges that let developers use familiar tools (such as PyTorch code) but run them on Huawei hardware. It’s like offering a button that converts your iPhone app to work on their system with one click.

Third, create a bridge for existing models. By heavily investing in ONNX—essentially the PDF of AI models—Huawei enables companies to train on Nvidia but deploy on Huawei with no rewriting required.

Is it working? Not yet.

Reality check: Chinese developers are still complaining. One described using Huawei’s system as “a road full of pitfalls.” Huawei’s online forums are ghost towns compared to Nvidia’s bustling communities.

People are complaining that CANN is a mess—unstable, hard to use, and lacking the community support that makes CUDA so accessible. Another noted that adapting models to run on Huawei’s platform is a slow, Huawei-dependent process.

Yet another predicted, “it will take until 2027 for CANN to be truly mature.” Compare that to Nvidia, where out-of-the-box performance is amazing, and support is just a forum post away.

Brute Force over Elegance

On the hardware side, Huawei is improving but still lagging. Its CloudMatrix packs twice the computing power of Nvidia’s latest rack, but consumes four times the energy. But in China, where electricity is cheap, delivering a punch while guzzling power is a strategic tradeoff Beijing is willing to make.

So why does this matter? Because the U.S. is playing a dangerous game. By restricting Nvidia’s exports to China—like banning the H100 in 2022 and tightening rules on the H20—they’re forcing Chinese companies like Alibaba, Tencent, and DeepSeek to look for alternatives.

Right now, those companies are still using Nvidia’s GPUs because they’re the best. But if the U.S. keeps tightening the screws by neutering Nvidia’s export options, Huawei’s product won’t look too bad in China.

Evidence of the “Boomerang Effect” of Sanctions

DeepSeek—China’s homegrown AI powerhouse—is already running models on Huawei’s cloud. The company still uses Nvidia for the heavy lifting in the training phase, but it’s proving Huawei can work for everyday use once its model is built.

Meanwhile, Huawei is sending engineers directly to companies like Baidu and Tencent, helping them switch—just like Nvidia did with scientists back in the 2000s.

We’ve seen this movie before with such things as solar panels, EVs, and batteries. China starts behind, iterates under pressure, then scales past everyone. The smarter U.S. play would be to keep Chinese developers hooked on CUDA, not shove them into Huawei’s arms.

The final irony is this: Trump’s policy doesn’t stop China from building AI—those models will get built, one way or another.

The real question is whether Nvidia can hold on to its software dominance. Because the moment Chinese developers decide Huawei’s CANN is “good enough,” Nvidia’s moat begins to drain.

Once that happens, Huawei will roll out its cheaper, sanctions-free stack through Southeast Asia, Africa, and the Middle East—just like it did with 5G. All because someone in Washington mistook hardware for the crown jewel when the real prize is the invisible empire of code.

What Does All This Mean for Your Business?

The short version is that the U.S.-China tech universe is no longer one big galaxy. The vast orbits of U.S. and Chinese tech are splitting apart.

In the past, this divide was surface-level—think WeChat versus WhatsApp, Amazon versus Alibaba, or the echo chambers locked behind China’s Great Firewall versus the U.S. internet.

But now, thanks to Washington’s decoupling push, the rift cuts deeper, fracturing AI, physical hardware, and firmware architecture. For tech companies, this means one word: interoperability.

Your systems need to be swappable, flexible—like banks running their data centers across AWS, Azure, and private clouds simultaneously. Without that agility, you’re locked into a single ecosystem while the ground shifts beneath you.

Even if you don’t build tech, you ignore China at your peril.

The mathematics of scale is jaw-dropping. China has:

Twice the U.S.’s electricity, 3× its cars, 13× its steel, 20× its cement, and 200× its commercial ships (plus 3× the U.S.’s warships).

Half the world’s chemicals and cargo vessels, two-thirds of its EVs, three-quarters of all batteries, 80 % of drones, and 80 % of solar panels and refined rare earths.

Advanced automation: China installed 7× as many robots as the U.S. in 2023—half the global total.

Rapid energy build-out: China has 100 advanced reactors in the pipeline—using tech America invented but mothballed.

So, what’s the play? Keep your eyes open and your options fluid. For tech firms, invest in systems that can pivot between ecosystems—because a world of fragmented standards is coming. Budget for CUDA and CANN the way you once did for AWS and Azure.

For everyone else, track China’s moves: subscribe to industry reports, attend global summits, or partner with firms straddling both markets.

Above all, stay curious.

Innovation doesn’t care about ideology. Immerse yourself in alternative ecosystems—not just China’s, but any that challenge your assumptions. Learn from them. Adapt.

In a bifurcating world, the winners won’t be ideologues—they’ll be the companies fluent in both languages of innovation.

If Sun Tzu were advising in 2025, he might add:

The supreme art of digital war is to make your platform indispensable—so even rivals build on it.

Subdue without fighting.

It is typical short term thinking and in this case the focus of Trump is playing to his base - but all of this is at a superficial level - which is a characteristic of short term thinking.

This highlights the deep shortcomings of the current administration best illustrated through Hans Christian Andersen's - "The Emperor Has No Clothes" - no-one dares challenge Trump, no-one looks beyond the superficial to dig deeper to look at the potential iterations of policy or worse still Trump's Executive Orders - at the end of the day - will the US become a 'house of cards' because of Trump?

Very interesting stuff, Howard!